新加坡上班族最佳儲蓄賬戶——最高利率

(本文內容如與銀行官網有差異,以銀行官網信息爲准。小編未從這些建議中獲得任何傭金。)

“我的儲蓄賬戶糟透了,有什麽更好的選擇?”

本文專門爲有工作幾年經驗的新加坡上班族而寫,希望重新考慮他/她是否有正確的儲蓄賬戶。

一個新加坡上班族的典型情景

薪水超過$3000,每月固定日期到銀行賬戶

花幾分鍾付賬單,房租$800, 信用卡賬單$500(每日費用,例如餐飲,電話費、水電費等的)

銀行賬戶余額1萬以上不等

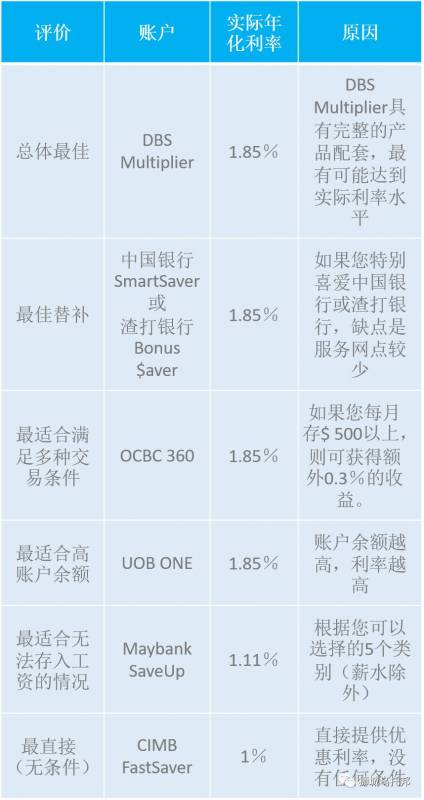

爲了完整起見,我們將比較新加坡的7個主要儲蓄賬戶 ,這些賬戶通常根據上述薪金和支出來使用。 我們不會比較短期內銀行促銷利率。

推薦策略:DBS Multiplier + Any DBS card

您很可能很早就開始使用DBS/POSB儲蓄賬戶

但是,小編認爲將您的儲蓄保留在該賬戶中是不明智的,因此您需要申請Multiplier賬戶。最好的組合是DBS Multiplier賬戶外加DBS/POSB任意一張信用卡,您可以在短時間內獲得最多的利息回報。

DBS組合的局限性

您將需要申請DBS信用卡産品並在其上花費最低金額(或其他類別)

他們的ATM隊列通常最長

因此,一些讀者可能仍然選擇開設並繼續使用OCBC 360或UOB ONE賬戶,在存款余額較低時,利息金額的差異並不顯著。(從1萬新元到3萬新元)

對于外國銀行賬戶(例如中國銀行,渣打銀行),通常網點有限,ATM取款可能更不方便。

重要注意事項:

請注意,以上圖表在很大程度上取決于相關卡的月度支出(返利)。

銀行在激烈競爭背後的事實是:世界上沒有免費的午餐。銀行提供優惠利率以獲取更多有關您的薪水和支出數據,並希望您將來購買其他銀行産品(例如貸款,抵押等)

此外,如果您想提出疑問或討論有關儲蓄賬戶和信用卡交易的更多信息,請在下方留言。

——————延伸閱讀——————

Savings Account: DBS Multiplier Account

Spending Card: DBS Credit cards

The Realistic interest rate of 1.55% was calculated with $2,600 worth of transactions = $2,000 Salary + $600 Card Spend

However, the best part about it is that you can just shift it around accordingly, for example, $2,600 worth of transactions = $2,500 Salary + $100 Card Spend

Total Eligible

Transactions

OPTION A:

Salary Credit AND

1 categoryOPTION B:

Salary Credit AND

2 or more categories

Below

S$2,000

0.05% p.a.0.05% p.a.

From

S$2,000

1.55% p.a.1.80% p.a.

From

S$2,500

1.85% p.a.2.00% p.a.

From

S$5,000

1.90% p.a.2.20% p.a.

From

S$15,000

2.00% p.a.2.30% p.a.

From

S$30,000

2.08% p.a.3.50% p.a.

Savings Account: BOC Smart Saver Account

Spending Card: BOC Family Card

CategoryBonus InterestConditions

Card

Spend

Up to 1.60%1.60% – Monthly Spent above S$1,500

0.80% – Monthly Spent S$500 –

0.80% – Salary S$2,000 –

3) SCB Bonus $aver

Savings Account: SCB Bonus $aver

Spending Card: SCB Credit Cards

Article is updated to reflect OCBC Bank’s update, effective from 1 November 2018.

Savings Account: 360 Savings Account

Spending Card: 365 Credit Card

Main Conditions for OCBC 360

CategoryCondition

First

$35,000

Next

$35,000

SalaryAt least S$2,000 through GIRO

1.20%

p.a.

2.0%

p.a.

SpendAt least S$500 on OCBC Credit Cards

0.30%

p.a.

0.60%

p.a.

(NEW!)

Step-UpIncrease your account balance by at least S$500 compared to previous month

0.30%

p.a.

0.60%

p.a.

WealthInsure or invest with OCBC Bank and earn this bonus interest for 12 months

0.60

%p.a.

1.20%

p.a.

Total Interest

2.40%

p.a.

4.40%

p.a.

Things to note:

If you plan to use OCBC 365 Credit Card for your “Spend” category, do note that OCBC 365 Credit Card requires a minimum spend of S$800 to be eligible for all their cashback.

Additional Interest Available to Earn for OCBC 360

CategoryConditionInterest Rates(NEW!)

BoostAdditional 1% on the difference from the previous month balance

(Capped at S$1,000,000 in your balance)1% p.a.Grow

(Old Name: “Save Bonus”)Earn this extra bonus on the first S$70,000 if your account balance is at least S$200,0001% p.a.

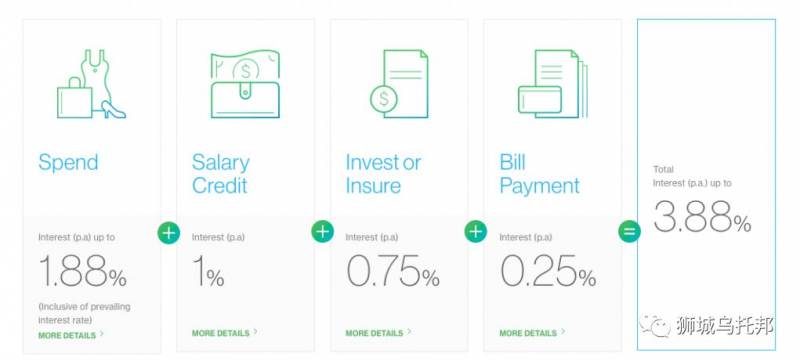

5) UOB ONE

Savings Account: UOB ONE Savings Account

Spending Card: UOB ONE Credit Card

Bank

Balance

OPTION A:

Card

Spend of min.

S$500

OPTION B:

Card Spend of min. S$500

AND credit your salary

OR make 3 GIRO debit transactions

First

S$15,000

1.50%1.85%

Next

S$15,000

1.50%2%

From

S$30,000

1.50%2.15%

From

S$45,000

1.50%2.30%

From

S$60,000

1.50%3.88%

From

S$75,000

0.05%0.05%

6) Maybank SaveUp

Savings Account: Maybank SaveUp

Spending Card: Maybank Credit Cards

Interest / Additional InterestsBase Interest0.3125% p.a.1 product or service0.3% p.a.2 products or services0.8% p.a.3 products or services2.75% p.a.

*Additional interest capped at first S$60,000 of the deposit.

9 Products from Maybank to choose from:

Credit Cards

GIRO

Salary Crediting

Education Loan

Hire Purchase Loan

Home Loan

Life Insurance

Renovation Loan

Unit Trusts

7) CIMB FastSaver

Most straightforward savings account WITH NO CONDITIONS.

Savings Account: CIMB FastSaver

Spending Card: CIMB Credit Cards

Account BalanceInterest RatesFirst S$50,0001.00% p.a.Above S$50,0000.60% p.a.