金融工程,大數據,商業分析,這些專業毫無疑問是近年申請的熱門方向。通過對這些專業的申請審理和錄取成功案例的分析,我們可以清晰地看到海外名校的偏好,原本商學院申請中常見的leadership、ethical dilemma之類題目現今越來越少見,各專業錄取紛紛更加側重對數理背景和編程能力的考查。而我們國內大部分商科專業,課程設置都偏文科,數學方面的知識偏少,編程更是涉及不多,再加上本科期間地域、學校資源的限制,本科生很難找到高含金量的實踐項目鍛煉這方面的知識與技能。

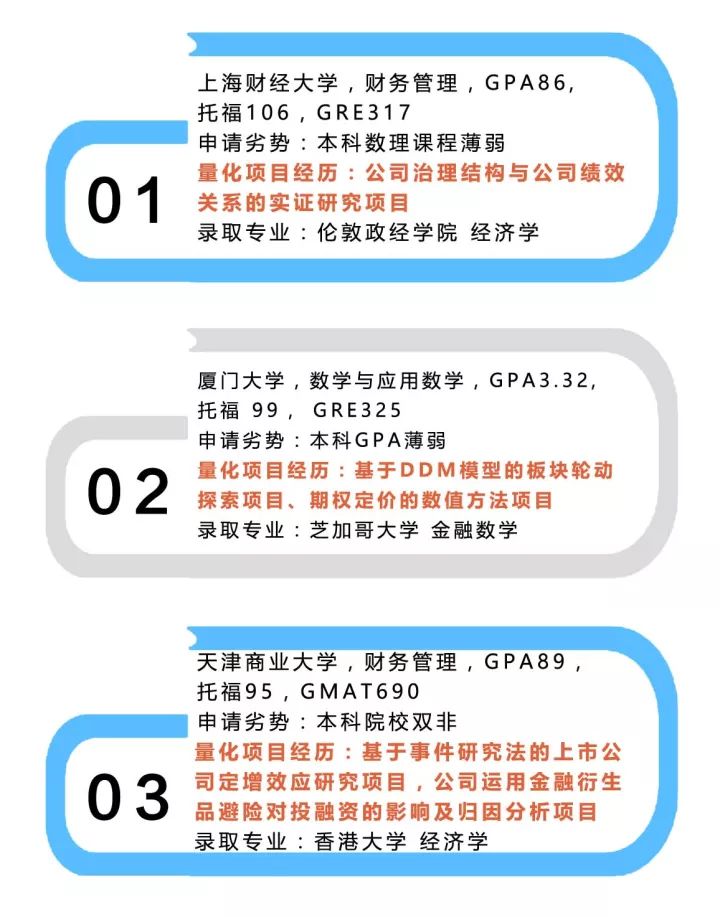

但是,即使在這樣激烈的競爭環境下,依然不乏轉方向申請成功和逆襲名校的案例。

以上這幾位學生成功錄取的共同之處就是,在申請之前都有量化項目經曆鍛煉自己的數據分析、編程等技能,並在後期的文書材料中加以證明,從而完美契合了國外招生官對目標人才的需求。

而指南者教育一直以來都致力于在申請之前就真正幫助學生提高自身競爭力,與其在申請的時候“難爲無米之炊”,不如先提升自身背景。在專業學習資料分享,雅思workshop、作文批改、一對一口語對練,暑研暑校資源的基礎上,指南者教育現針對大二及以上的商科同學推出“名企量化實習”項目,除了幫助大家增加一段對口的專業經曆外,更加可以通過這個項目,彌補數理分析和編程能力的不足,更好地服務申請及之後的就讀和職業發展。

1量化實習適用人群

打算申請金融、金工、商業分析、經濟、運籌、風險管理等商科專業研究生,且目前數理背景/項目經曆薄弱的同學。

2指南者“名企量化實習”有何特點?

比起市面上動辄上萬結果只是水一水的實習,指南者教育商科“名企量化實習“以提升學生競爭力拿到dream school爲最終目的,培訓內容緊緊圍繞國外招生院校要求展開,真正培養學生申請專業所需的知識與技能,同時收獲高含金量項目經曆與推薦信。

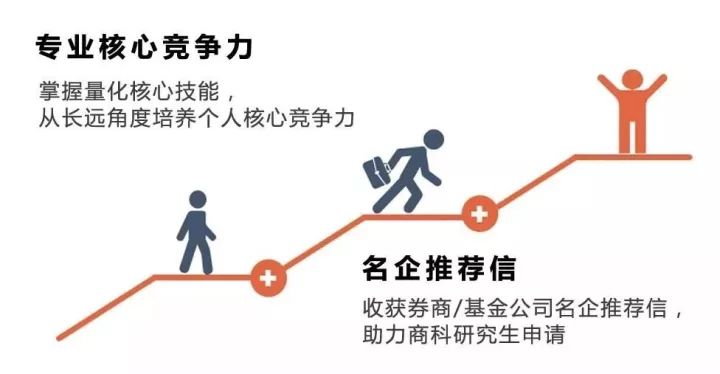

1、專業核心競爭力

量化實習的培訓內容是基于國外院校招生、企業招聘人才的標准精心設計的,商科人才所需的理論基礎、數據處理、模型構建、軟件應用、研報撰寫等專業知識與技能都可以通過本次培訓獲得,對學生後期的申請和就業有很大的幫助。

2、名企推薦信

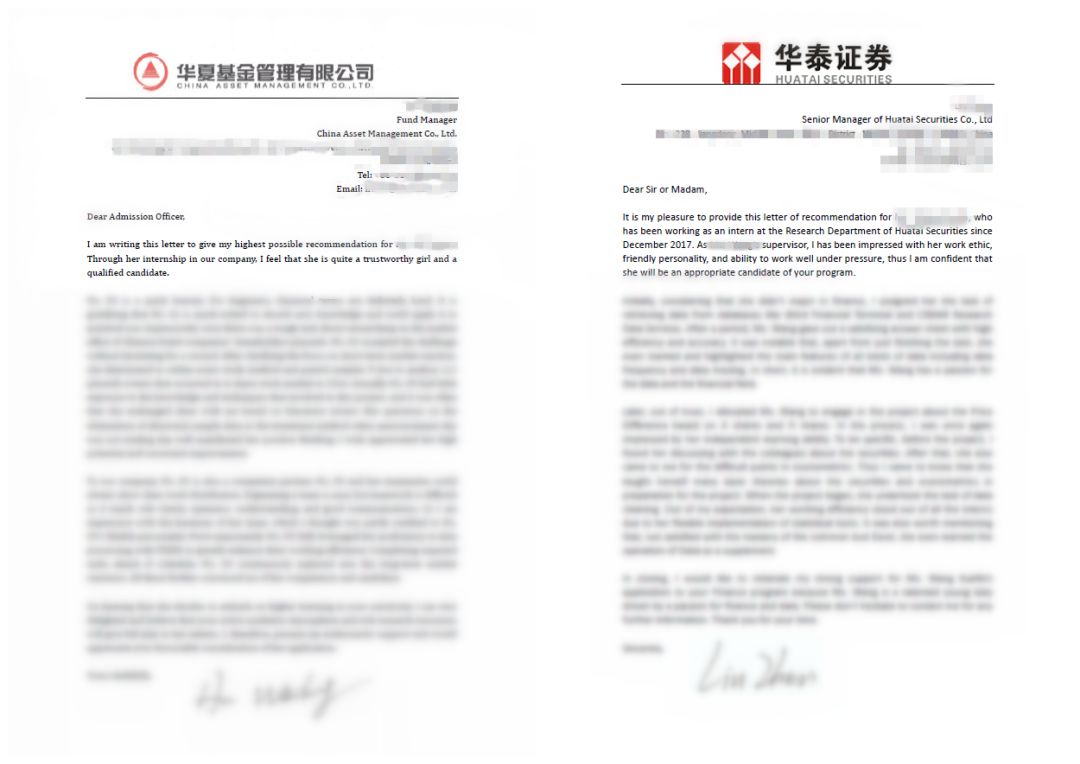

量化實習的每個項目均是來自券商/基金公司的實戰項目,每個項目結束後,我們都將在學校申請階段提供該項目對應公司的推薦信。可獲得的推薦信公司包括:華泰證券、中信證券、興業證券、招商基金、華夏基金。

3“名企量化實習”項目培訓安排細則

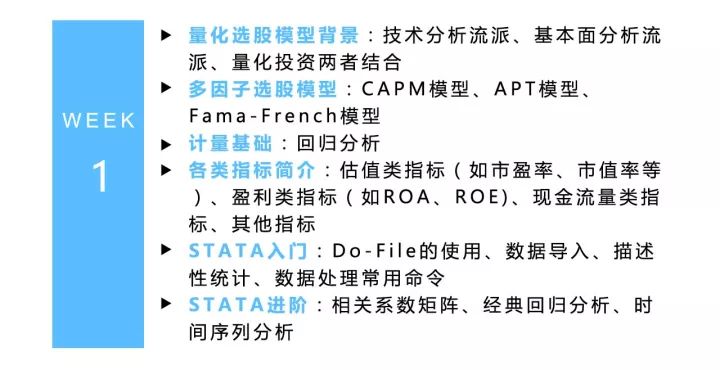

第一階段:補充金融計量基礎知識及軟件工具

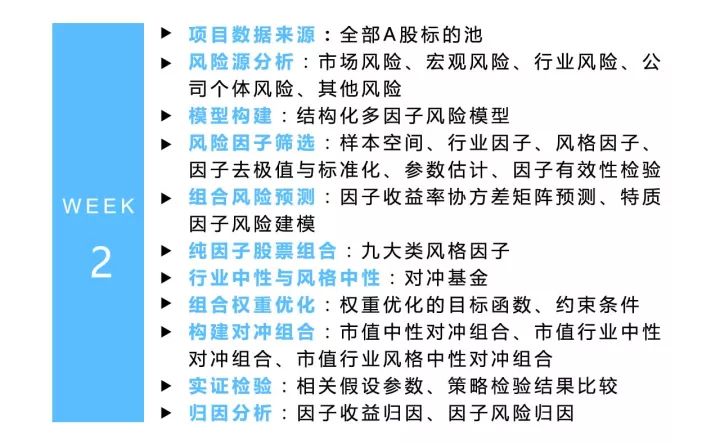

第二階段:量化項目逐步精講指導(以風格中性多因子選股策略項目爲例)

第三階段:分配並指導學員完成項目及項目報告,查驗培訓成果

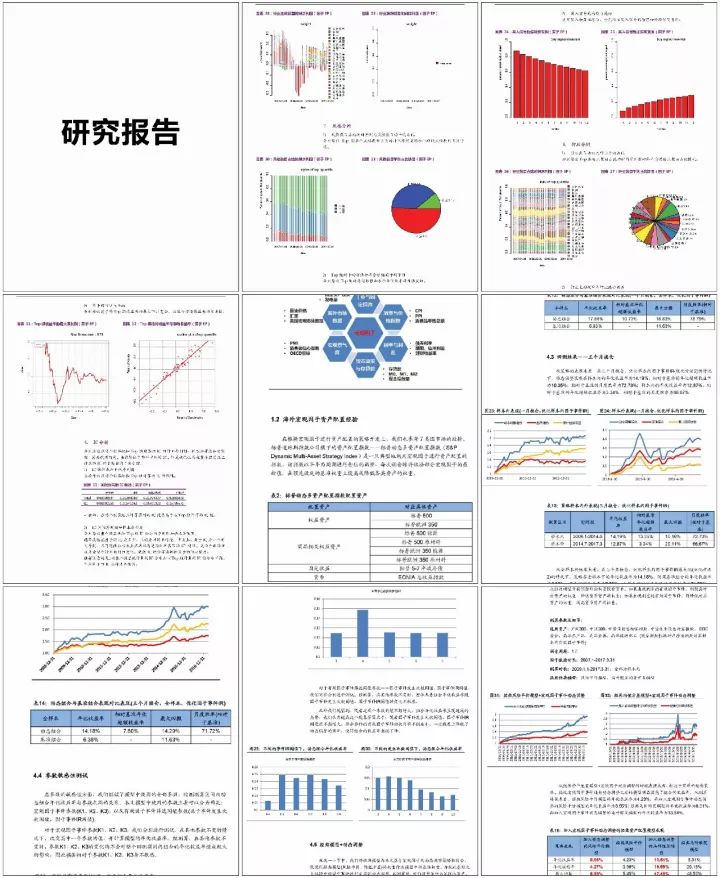

成果展示:

名企推薦信:

4頂級商科導師指導文書寫作

針對購買留學申請服務的學員,指南者的海外頂級商科導師還會具體指導如何在文書中展示這段經曆。

(部分導師展示)

量化經曆節選1(個人陳述):

(上下滾動查看全文)

A notable experience happened in my junior year when I decided to research on the effect of investors’ heterogeneous beliefs on stock prices. With only a smattering of professional knowledge, I conducted literature review at first. As studies on stock price from the point of heterogeneous beliefs had a short history of only two or three decades, there was few literature available. In spite of this, I summarized the general structure of previous research projects, then collected data of Chinese stock market and attempted to find out suitable proxy variables that were not mentioned yet. To produce the better imitative effect of the regression equation, I selected average daily turnover and excess return as explanatory variables and their joint effect as a new variable. Things didn’t always go smoothly in reality. Problems were encountered in data processing. Heteroscedasticity was unexpectedly detected after F test. Instead of being anxious, I calmed down, consulted materials, and figured out problems in the number of variables for asset pricing due to my lack of mastery of explanatory variables. To settle this problem, I added more variables such as closing price and trading days in a year into a regression analysis, checked through the residual plot, Lagrange multiplier test, and White test, and eventually eliminated heteroscedasticity. The final results indicated that heterogeneous belief and stock price are correlated in a positive fashion, meaning that the more serious the heterogeneous belief is in the market, the more likely the stock price is to be overvalued, and then the crash phenomenon is more likely to occur. Thanks to my novel topic, rigorous data processing, and standard paper writing, my research earned the highest score in the class. In this research, my skills in data handling with Stata and my understanding of econometrics and statistical analysis were greatly developed. I treasure such an experience that inspired me to pay a close eye to financial markets, to incorporate theories into realities, and to apply thoughtful mind in problem-solving.

量化經曆節選2(個人陳述):

(上下滾動查看全文)

Curiosity is my nature. It guided me in every adventure to the unknown world. As the bank loan is still the main channel for the enterprise to get financial support, most studies preoccupied mainly with the problem of asymmetrical information in small-medium enterprises’ financing, while overlooking the investigation of individuality of enterprise management stratum. But in my opinion, CFO gender plays an important role in ensuring the quality of the financial report and choosing an investment item which impacts the success of enterprises’ lending from the bank. The idea aroused my curiosity to do the related research. Indeed, as a new research field, few studies have been done, and the results are inconclusive. I had to seek out information and gather the necessary data all on my own. During that time, I stayed in the library all day long, buried myself in the vast amount of documents, and exercised my collect and handle information ability to the fullest extent to look for research materials from the internet, the library and other sources. After my unremitting efforts, I found twenty thousand CFO gender statistics of Shenzhen Stock Exchange listed the company in Wind Information as well as corresponding bank-lending numbers. Given enough data, I had thought the research would go well, but until then I learned the data processing and analysis is the most crucial part. Facing the large numbers of multifarious data, I didn’t know that from where to start. I encountered the most severe test. But I didn’t give up, I ordered data into groups and processed into easy-to-read excel form. However, the use of EXCEL data-processing functions is not enough to fulfill the data analysis needs. So I taught myself SPSS software through professional books and many exercises and within the shortest possible time I mastered all the necessary knowledge regarding the correlation analysis. Then I carried on multivariate correlation analysis between CFO gender and the factors that determine the bank loan. Although I haven’t considered all control variables thus my study is ongoing now, yet it was the first time I really conduct a practical research. I have experienced the joys of research from the data collection and correlational analyses. I not only improved my self-learning ability but also cultivated the capacities to analyze and solve problems using quantitative analysis.

項目主講人

指南者教育馬老師

同濟大學優秀畢業生

香港城市大學金融與經濟系Senior Research Assistant,前老板爲現任港大金融學項目錄取委員會成員

3年全職券商投行部工作經驗

現爲指南者全職工作人員

報名須知

1、名企量化實習項目主要培訓數據分析與編程技能,非商科但想獲得此技能的同學也可報名參加;

2、費用:非內部簽約學員3999(含一份推薦信),簽約學員3999(不限推薦信份數)。聽完前兩節課不滿意可以申請無條件免費退款;

3、小班培訓,每期人數僅限12人,先到先得。

4、春季班開營時間:四月中旬。

報名方式