2020年是我國公募REITs元年,我國基礎設施公募REITs已正式起步。然而,此次公募REITs試點項目的推行,主要針對的是基礎設施領域的項目,國家發改委發布的《關于做好基礎設施領域不動産投資信托基金(REITs)試點項目申報工作的通知》中明確指出酒店、商場、寫字樓、公寓、住宅等房地産項目不屬于試點範圍。2021年3月30日,央行、銀保監會、證監會、外彙局發布的《關于金融支持海南全面深化改革開放的意見》已進一步支持海南在住房租賃領域發展房地産投資信托基金(REITs) ,但總體而言,針對商業房地産項目發行公募REITs的政策仍未全面開放。因此,對于境內的存量房地産項目而言,通過境內公募REITs實現重資産退出仍有待時日。此外,類REITs的稅負又顯得過重,因此,很多企業仍會選擇赴新加坡發行REITs上市。根據筆者了解,境內一家房地産企業將于今年5、6月份登陸新交所REITs上市。

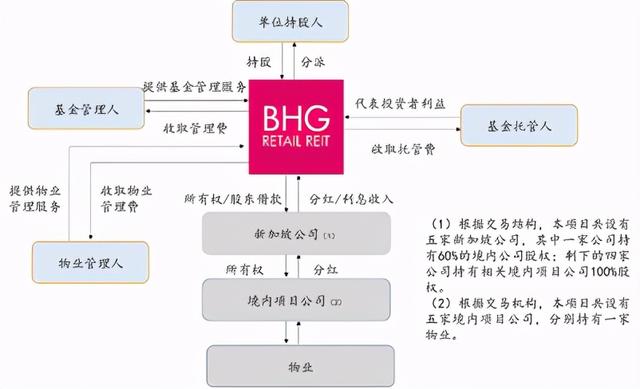

本系列文章主要依據新加坡交易所(Singapore Exchange Limited,SGX)公示的境內企業新加坡REITs上市的招股說明書(Prospectus)的內容,進一步總結介紹截至目前爲止已在新交所上市的中資REITs項目情況。本文附件摘錄了BHG Retail REIT招股說明書及2019年都報告中的部分內容,供讀者進一步了解BHG Retail REIT項目相關情況。

2015年12月11日,北京華聯商業信托(BHG Retail REIT,或稱“華聯REITS”)于新加坡交易所主板REITs上市,是中國大陸第一家在新加坡上市的房地産投資信托。本文主要從BHG Retail REIT項目的基本情況、包括交易結構在內的核心法律問題及2019年財務情況等部分內容進行介紹。

一、項目基本情況

1、物業(Properties)情況

由五個零售地産物業組成,分別爲位于北京的北京華聯萬柳購物中心(華聯REIT占北京物業60%的權益)、位于成都的北京華聯成都空港購物中心、位于合肥的北京華聯合肥蒙城路購物中心、位于西甯的北京華聯西甯花園店和位于大連的北京華聯大連金三角店,物業整體總面積263,688平米,可出租面積155,977平米,出租率92.7%。

2、基金管理人(Manager):BHG Retail Trust Management Pte. Ltd.

收費標准:REITs可分配收益的10%(基礎費用)以及兩個財政年度REITs單位派息差的25%(業績費)。

3、基金托管人(Trustee):DBS Trustee Limited

收費標准:每年不超過REITs資産的0.1%,每月最低10000新元。

4、物業管理人(Property Manager):新加坡商業公司的全資子公司 BHG Mall (Singapore) Property Management Pte. Ltd以及北京華聯商廈股份有限公司的全資子公司成都華聯弘順物業管理有限公司(鑒于北京華聯持有北京物業60%的股權,故另行安排成都華聯弘順物業管理有限公司,對北京物業提供物業管理服務)。

收費標准:每年物業收入總額的2.0%、每年物業淨收入的2.5%及針對新租客收取的兩個月的固定租賃傭金。

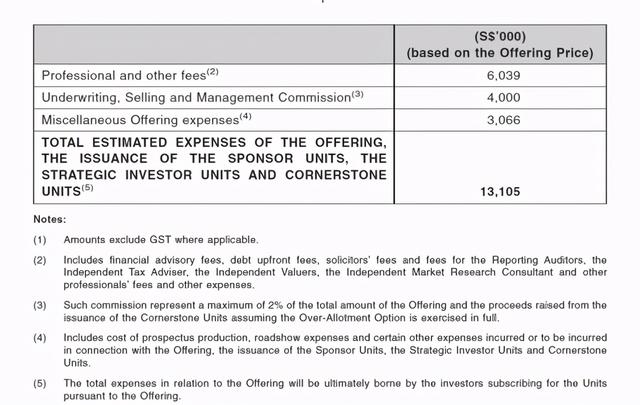

5、發行費用

華聯REIT的發行費用主要包括承銷費、管理費、中介機構費用(包括律師費、財務顧問費、審計費、評估費等)以及其他與發行相關的費用,合計約1300萬新幣(以發行費用0.8元新幣爲基准)。

二、核心法律問題

(一)交易結構之重組方案

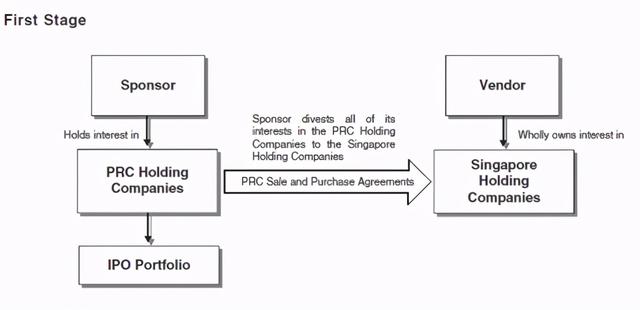

本項目中,華聯REIT重組方案主要如下:

步驟一:新設五家新加坡公司(Singapore Holding Companies);

步驟二:新加坡公司分別收購境內的五家項目公司(PRC Holding Companies)的股權,五家項目公司分別持有五家零售地産物業(北京華聯萬柳購物中心、北京華聯成都空港購物中心、北京華聯合肥蒙城路購物中心、北京華聯西甯花園店和北京華聯大連金三角店),其中北京華聯萬柳購物中心的項目公司系由北京華聯和北京萬柳共同持股(北京華聯持有60%的股權);

步驟三:成立新加坡華聯公司(BHG Singapore),並由其設立本項目的基金管理人和物業管理人。

(二)境內物業合法合規情況

鑒于本項目中的基礎資産均爲境內的物業,故對于境內物業資産的合法合規情況均需滿足國內法律法規的要求。

1、 境內五家物業資産的權屬清楚、明晰;

2、 物業資産需要依據國內法律法規的規定,合法取得(1)建設用地規劃許可證;(2)建設工程規劃許可證;(3)建築工程施工許可證;(4)國有土地使用證/不動産權證。

3、 物業資産同時需要根據國內法律法規的規定,履行竣工驗收、消防驗收、環評等手續。

(三)稅收

1、REITs層面

根據新加坡的稅收政策,REITs層面只要滿足分紅比例超過90%(即每年營業收入不少于90%的部分,按照季度、半年或者年的頻率以分紅的形式分給投資者),則來自于房地産及房地産相關資産的現金收入部分無需繳納所得稅。

2、投資者層面

根據新加坡的稅收政策,投資者是企業的,在新加坡需要繳納17%的所得稅;投資者爲個人的;免征個人所得稅。

三、BHG Retail REIT近期表現

(一)2019年度財務情況

(數據來源:BHG Retail REIT 2019年度報告)

(二)BHG Retail REIT近期表現

(截至2021年4月14日的數據,來源:https://cn.investing.com/equities/bhg-retail-reit)

附件:

Part one:Basic Information of BHG Retail REIT

On 11 December, 2015, BHG Retail REIT, belonging to Beijing Hualian Group Investment Holding Co., Ltd. (“Beijing Hualian Group”),listed on the Main board of Singapore Exchange Limited,which became the first pure-play china retail REIT sponsored by a China-based Group.

BHG Retail REIT is a Singapore real estate investment trust (“REIT”) established with the investment strategy of investing principally, directly or indirectly, in a diversified portfolio of income-producing real estate which is used primarily1 for retail purposes (whether either wholly or partially), as well as real estate-related assets in relation to the foregoing, with an initial focus on China.

1、 Properties

The initial portfolio of BHG Retail REIT will comprise five retail properties strategically located in Tier 1, Tier 2 and other cities of significant economic potential in China:

(1) a 60.0% interest in Beijing Wanliu Mall (北京華聯萬柳購物中心) (“Beijing Mall”).Beijing Mall comprises seven storeys and is in close proximity to Zhongguancun and surrounded by high-end residential developments and educational institutions including several universities;

(2) Hefei Mengchenglu Mall (北京華聯合肥蒙城路購物中心) (“Hefei Mall”). Hefei Mall comprises several mature residential communities, a number of government organisations and high quality office projects;

(3) Chengdu Konggang Mall (北京華聯成都空港購物中心) (“Chengdu Mall”). Chengdu Mall comprises seven storeys and is located in an emerging residential area which comprises high density residential communities and targets upper middle class shoppers including young families with children;

(4) the 15,345.08 sq m of space known as Dalian Jinsanjiao Property (北京華聯大連金三角店) (“Dalian Property”). The Dalian Property is master leased to Beijing Hualian Hypermarket Co., Ltd. (“BHG Hypermarket”) which is listed on the Shanghai Stock Exchange (see “The Sponsor – Beijing Hualian Group” for further details); and

(5) Xining Huayuan Mall (北京華聯西寧花園店) (“Xining Mall”). Xining Mall comprises four storeys and is under a master lease with BHG Hypermarket as the master lessee.

2、Manager

BHG Retail Trust Management Pte. Ltd. is the manager of BHG Retail REIT. The Manager was incorporated in Singapore under the Companies Act, Chapter 50 of Singapore on 12 February 2015.

Management Fee:

i. Base Fee:10.0% per annum of the Distributable Income.

ii. Performance Fee: 25.0% of the difference in DPU in a financial year with the DPU in the preceding full financial year (calculated before accounting for the Performance Fee in each financial year) multiplied by the weighted average number of Units in issue for such financial year.

2、 Trustee

The trustee of BHG Retail REIT is DBS Trustee Limited. The Trustee is a company incorporated in Singapore and registered as a trust company under the Trust Companies Act, Chapter 336 of Singapore.

Trustee’s fee:The Trustee’s fee shall not exceed 0.1% per annum of the value of the Deposited Property, subject to a minimum of S$10,000 per month, excluding out-of-pocket expenses and GST in accordance with the Trust Deed. The actual fee payable shall be agreed in writing between the Manager and the Trustee. The Trustee’s fee shall accrue daily and paid monthly in arrears in accordance with the Trust Deed.

4、Property Manager Group

The Property Manager is BHG Mall (Singapore) Property Management Pte. Ltd. The Property Manager is a wholly owned subsidiary of the Sponsor established in Singapore on 20 September 2015 under the Companies Act.

Chengdu Hualian Hongshun Property Management Co., Ltd. (成都華聯弘順物業管理有限公司), a subsidiary of the Sponsor, is the PRC property manager (the “PRC Property Manager”). The PRC Property Manager which provides property management services in China and, together with the Property Manager, are referred to collectively as the “Property Manager Group”.

Property management fee:

i. 2.0% per annum of Gross Revenue for the relevant property;

ii. 2.5% per annum of the Net Property Income for the relevant property (calculated before accounting for the property management fee in that financial period); and

iii. 2 months of Fixed Rent as leasing commission for securing of new tenants for a tenancy of at least three years, commencing for new tenancies entered into from 1 January 2018.

5、Issue Expense

The estimated amount of the expenses in relation to the Offering, the issuance of the Sponsor Units, the Strategic Investor Units, and Cornerstone Units of S$13.1 million (based on the Offering Price of S$0.80) includes the Underwriting, Selling and Management Commission, professional and other fees and all other incidental expenses in relation to the Offering, the issuance of the Sponsor Units, the Strategic Investor Units and Cornerstone Units, which will be borne by BHG Retail REIT. A breakdown of these estimated expenses is as follows(1):

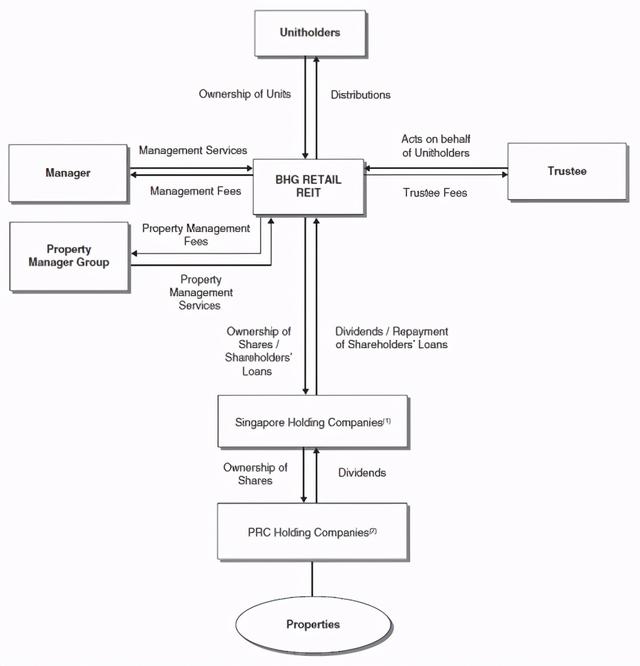

Part two:Structure of BHG Retail REIT

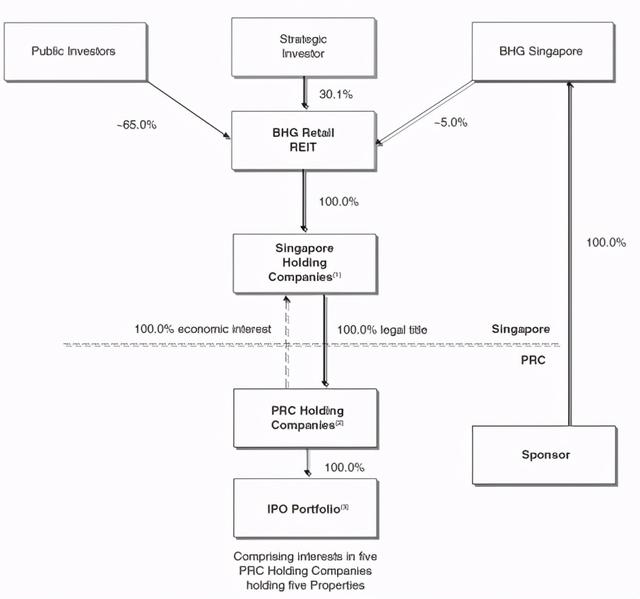

The following diagram illustrates the relationship between BHG Retail REIT, the Manager, the Trustee, the Property Manager Group and the Unitholders as at the Listing Date:

Notes:

(1) There are five Singapore Holding Companies, one holding a 60.0% interest in the PRC Holding Company which is a joint venture company and the remaining four each holding 100.0% equity interest in the relevant PRC Holding Companies.

(2) There are five PRC Holding Companies, each holding one Property.

Part three:Core legal issues

1、Reorganization

(1)Overview

The Properties in the IPO Portfolio were initially indirectly owned by the Sponsor through the PRC Holding Companies. A series of steps were undertaken in compliance with the relevant PRC laws and regulations (the “Reorganization”). The Vendor, Zhang Gaobo, who is unrelated to the BHG Group’s companies, incorporated five Singapore Holding Companies and acquired from the Sponsor its equity interests in the PRC Holding Companies holding the Properties (the“Acquisition”). The other steps involved in the Reorganization included the incorporation of BHG Singapore, a wholly owned subsidiary of the Sponsor, which further incorporated (i) BHG Retail Trust Management Pte. Ltd. to act as the manager of BHG Retail REIT, and (ii) BHG Mall (Singapore) Property Management Pte. Ltd., which has been appointed as the property manager of the properties held by BHG Retail REIT. Both the Manager and the Property Manager are wholly owned subsidiaries of BHG Singapore.

(2)Details of the Reorganization

The Vendor established the five holding companies in Singapore, being Petra 1, Petra 2, Petra 3, Petra 4 and Petra 6. The Vendor legally and beneficially owns 100.0% of the issued share capital of each of the Singapore Holding Companies.

BHG Singapore established and wholly owns the Manager and the Property Manager.

The following diagram illustrates the foregoing steps of the Reorganization:

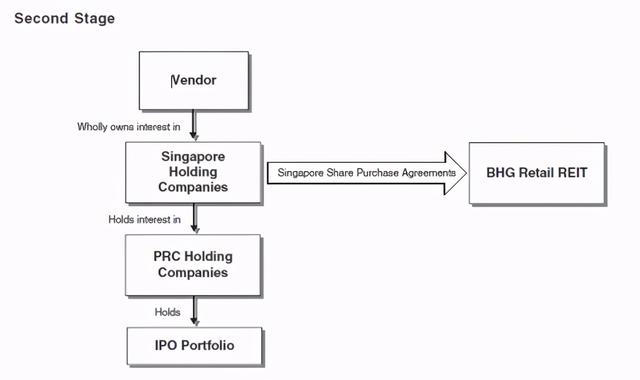

The following diagram sets out the holding structure of BHG Retail REIT pursuant to the Offering:

Notes:

(1) BHG Retail REIT holds 100.0% of the issued share capital of the five Singapore Holding Companies.

(2) There are five PRC Holding Companies, each holding one Property. Save for the joint venture company holding Beijing Mall in which BHG Retail REIT only had 60.0% equity interest, BHG Retail REIT will have a 100.0% equity interest in each of the remaining PRC Holding Companies.

(3) The five Singapore Holding Companies indirectly own BHG Retail REIT’s interest in the IPO Portfolio which comprises the five Properties.

2、Risk factors relating to China

i. BHG Retail REIT may be exposed to risks associated with exchange rate fluctuations and changes in foreign exchange regulations.

ii. The PRC government has implemented property control measures in relation to the PRC property market.

iii. BHG Retail REIT is subject to extensive PRC regulatory control on foreign investment in the real estate sector.

iv. The Singapore Holding Companies may not be able to benefit from the reduced dividend withholding tax (“WHT”) rate provided under the Singapore-China avoidance of double taxation agreement.

v. The Singapore Holding Companies and BHG Retail REIT may be classified as China tax resident enterprise (“TRE”) for the purposes of PRC CIT, which could result in unfavorable PRC tax consequences for BHG Retail REIT and the Unitholders.

vi. Delay by the PRC tax authorities in assessing taxes could affect the amount of distributions.

vii. There is uncertainty in relation to MOFCOM approval when a disposal is made to BHG Retail REIT in accordance with the Voluntary Sponsor ROFR or the Beijing Hualian Group ROFR.

viii. Interpretation and application of the PRC laws and regulations involves uncertainty.

ix. The building standards applicable and materials employed in China may not be as stringent as those in other jurisdictions.

x. China’s political policies and foreign relations could affect the Properties.

xi. China’s economic reforms could affect BHG Retail REIT’s business.

3、Taxation

(1)Taxation of BHG Retail REIT

Except as detailed in the paragraphs below, BHG Retail REIT is liable to Singapore income tax on the following income:

(a) income accruing in or derived from Singapore; and

(b) income derived from outside Singapore (i.e. foreign-sourced income) which is received in Singapore or deemed to have been received in Singapore by the operation of law.

The above income will be referred to as “Taxable Income”.

Taxable Income is subject to tax at the trustee level. The tax is assessed on the Trustee at the prevailing corporate tax rate, currently 17.0%.

(2)Taxation of Unitholders

Distributions by BHG Retail REIT

Subject to BHG Retail REIT’s distribution policy (see “Distributions”), BHG Retail REIT’s distributions may be made out of the following receipts:

(a) tax-exempt dividends received from the Singapore Holding Companies (“Tax-Exempt Income”); and

(b) capital receipts from the repayment of shareholder’s loans by the Singapore Holding Companies (“Capital Receipts”).

Distributions out of Tax-Exempt Income

Unitholders will not be liable to Singapore income tax on distributions made out of Tax-Exempt Income.

Distributions out of Capital Receipts

Unitholders will not be liable to Singapore income tax on distributions made out of Capital Receipts. Such distributions will be treated as returns of capital for Singapore income tax purposes.

For Unitholders who hold the Units as revenue assets and are liable to Singapore income tax on gains arising from the disposal of their Units, they should reduce their cost of Units by the amount of return of capital received for the purpose of calculating the amount of taxable gains when the Units are subsequently disposed of. If the amount of return of capital exceeds the cost of the Units, the excess will be subject to tax as trading income of the Unitholders.

Distributions out of Taxable Income

Unitholders will not be liable to Singapore income tax on distributions made out of Taxable Income. Unitholders are not entitled to tax credits for any taxes paid/payable by the Trustee on such Taxable Income.

Distributions out of gain on disposal of shares in Singapore Holding Companies

Unitholders will not be liable to Singapore income tax on distributions made out of BHG Retail REIT’s gain on disposal of shares in the Singapore Holding Companies which is capital in nature.

If the gain on disposal of shares in the Singapore Holding Companies is assessed to tax on the Trustee (i.e. if it is considered income derived from a trade or business or if the shares in the Singapore Holding Companies were acquired with the intent or purpose of making a profit from their subsequent sale and not for long-term investment purposes), Unitholders will not be liable to Singapore income tax on distributions made out of such gain as the gain would have been taxed on the Trustee. Unitholders are not entitled to tax credits for any taxes paid/payable by the Trustee on such gain.

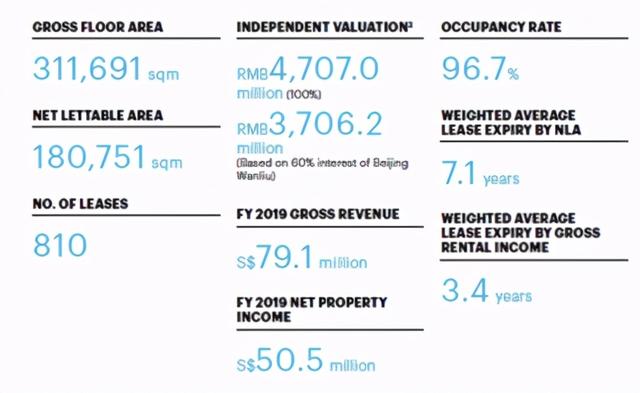

Part four:Financial information of 2019

1、Gross revenue

Gross revenue was RMB58.9 million (17.3%) and S$9.4 million (13.5%) higher year-onyear respectively. The increase in gross revenue was due to new contribution from Hefei Changjiangxilu, which was added into the portfolio commencing 2 April 2019, as well as stronger organic growth from the preacquisition portfolio. All properties displayed robust occupancy rates as well as healthy rental reversion for new and renewed leases.

2、Net property income

Net property income in RMB and SGD was RMB31.9 million (14.3%) and S$4.8 million (10.6%) higher yearon-year respectively. The higher net property income was due mainly to the new contribution from the enlarged portfolio, as well as an increase in rental revenue, and partially offset by the higher property operating expenses.

3、Annual distribution yield

Based on the closing price of S$0.685 as at 31 December 2019, and aggregated distribution per unit (“DPU”) for FY 2019 of 3.87 Singapore cents, BHG Retail REIT’s annual distribution yield of 5.6% continues to represent an attractive long-term yield-play investment.

4、Independent valuation of investment properties

As at 31 December 2019, BHG Retail REIT’s investment properties were valued at RMB4,707.0 million. The valuation represents an increase of RMB625.9million (15.3%) or S$100.7 million (12.5%) from the independent valuation as at 31 December 2018 of RMB4,081.1 million or S$808.3 million respectively. Excluding the contribution from Hefei Changjiangxilu which was acquired in April 2019, overall valuation of existing properties in RMB and SGD rose 3.3% and 0.7% respectively year-on-year.