全文共計16933字,預計閱讀時間9分鍾

來源 | 數據觀(轉載請注明來源)

作者 | Joresa Blount

編譯 | 黃玉葉

編輯 | 蒲蒲

2018年,亞洲在區塊鏈就業增長、加密貨幣使用、創新和總體開放方面處于領先地位。盡管早期中國禁止ICO帶來了一些麻煩,但中國仍然生成了近70%的加密采礦活動。

對于用戶和企業來說,亞洲區塊鏈生態系統總體而言是友好的。例如,在新加坡,比特幣被當作商品而非貨幣進行征稅,對使用比特幣進行交易的買賣設定7%的統一稅率;在日本,通訊軟件巨頭LINE 剛獲得日本金融監管機構頒發的加密兌換許可證;在韓國,有消息稱該國最大的娛樂公司SM娛樂即將推出自己的代幣……

除了一些正在探索加密解決方案的知名公司,還有數百家創新型初創企業和創始人希望用區塊鏈技術徹底顛覆各自的行業。以下這份名單包含了10家亞洲最值得關注的創新型區塊鏈初創公司,包括交易所、初創金融科技公司等。

Level01

-

官網:https://level01.io/

Level01是全球首家與湯森路透合作的無經紀衍生品交易所。通過利用區塊鏈技術,該平台消除了中間商,同時提供了分散式交易體驗。用戶可以從Level01平台和APP上交易外彙、加密貨幣、商品、股票、股指中的衍生品和期權。

數據觀注釋:湯森路透——Thomson Reuters,由加拿大湯姆森公司{The Thomson Corporation}與英國路透集團{Reuters Group PLC}合並組成的商務和專業智能信息提供商)

Level01通過使用分布式分類賬技術(DLT)在區塊鏈上實現透明和自動化的貿易結算,其獨特的人工智能(AI)分析工具Fairsense基于湯森路透當前和可追溯的市場數據,爲交易對手動態提供公允價值定價。該平台和應用程序目前正在接受50名經驗豐富的交易員的嚴格測試。

Galaxy Pool

-

官網:http://www.galaxypool.co/

Galaxy Pool,又稱GPO,是區塊鏈上一種全新的資産發行方式,它利用智能合約進行初始數字資産發行。一般而言,GPO資産可以被認爲是挖掘各種數字資産的采礦機器,這些數字資産可以通過回購和破壞池利潤來獲得GPO的增值收益。

憑借區塊鏈上這種全新的資産發行方式,可以爲投資者提供更人性化的投資機會和自由提現權。

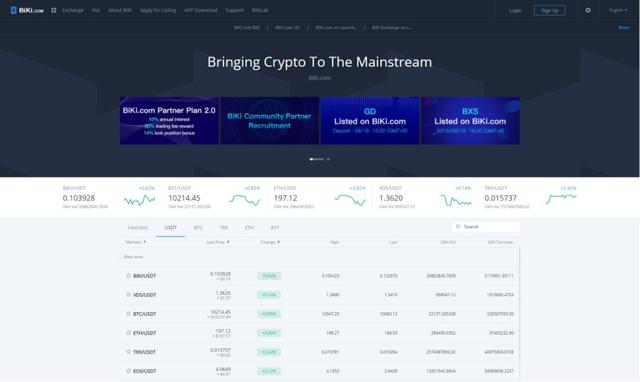

Biki

-

官網:https://www.biki.com/

BiKi.com總部位于新加坡,是一家全球加密貨幣交易所,在CoinMarketCap(知名代幣排名網站)上排名前20 位。BiKi.com提供數字資産平台,用于交易超過150種加密貨幣和220種交易對。自2018年8月正式開業以來,BiKi.com被認爲是世界上增長最快的加密貨幣交易所之一,一年內累計注冊用戶150萬,每日活躍用戶13萬人次,社區合作夥伴超過2000個,社區成員達20萬。

BiKi的競爭優勢包括爲不同項目通過在市場營銷、網紅和品牌知名度方面的幫助,已經幫助他們在中國市場和海外市場推動社區增長。Biki通過全球化的方法幫助中國企業走向全球,讓國際公司進入中國市場。

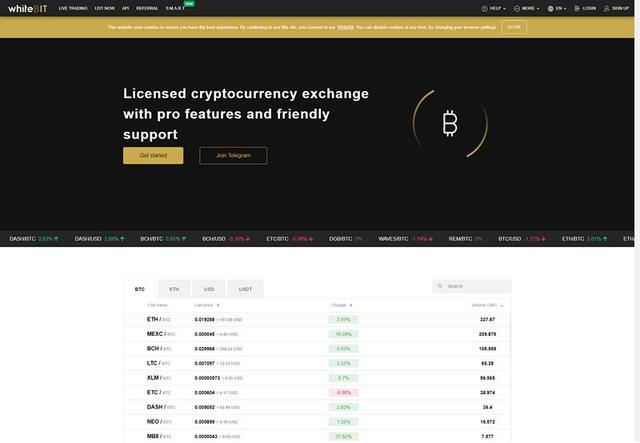

Whitebit

-

官網:https://whitebit.com/

Whitebit擁有一支由100多人組成的全球團隊,是一個專業的數字資産交易平台,通過歐洲許可證爲大多數主要亞洲市場提供服務。該交易所將95%的用戶資金存放在冷錢包中,並爲用戶提供直觀的用戶界面,包括實時訂單,圖表和技術分析工具以及自動化功能。Whitebit的主要競爭優勢是處理速度高達每秒一萬次以及一百萬個TCP連接。

Whitebit還宣布推出S.M.A.R.T. Box,該計劃允許用戶根據具有不同持續時間和利率的獨特計劃進行預算和分配資金。接下來,Whitebit還打算在2020年第四季度推出融資融券交易,以及移動iOS和Android應用程序,並最終獲得美國牌照。

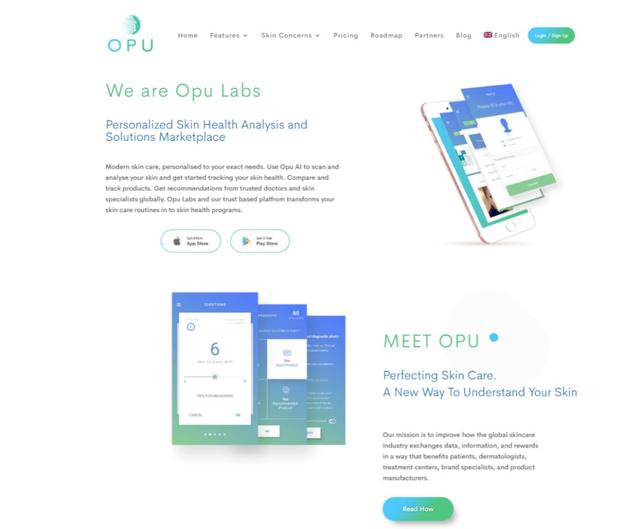

Opu Labs

-

官網:http://www.opulabs.com/

Opu Labs正在從護膚領域打造未來的自我護理商業模式。他們擁有超過12億的在線護膚消費者,數字服務業務價值30億美元。Opu Labs提供基于AI技術的免費建議,並利用區塊鏈技術獎勵購買數據的用戶,將先進技術用于連接品牌和消費者,幫助簡化決策過程。

在首席執行官Marc Bookman的領導下,Opu Labs被CIO Applications評爲全球前25大醫療解決方案,並在新加坡贏得了初創企業大滿貫。截止目前,該平台已經獲得200萬美元的獎勵,該公司將很快發布他們期待已久的應用程序。

Coinsbit.io

-

官網:https://coinsbit.io/

Nikolay Udianskyi憑借他豐富的專業能力、經驗和市場意識,創建了一個名爲Coinsbit.io的高質量加密貨幣交易平台。如今Coinsbit.io主導著亞洲加密貨幣市場,被評爲2019年亞洲區塊鏈領域2018年最佳加密貨幣平台。

Coinsbit正計劃通過一系列新穎的功能進一步從競爭中脫穎而出。該公司的計劃之一是推出P2P小額貸款服務,允許用戶在平台上借貸。Coinsbit將確保所有用戶的隱私,並且不會要求借款人出示他們的信用記錄。另外一個計劃中的功能是一個投資箱服務,它將通過支付各種硬幣的利息來獎勵那些存儲加密貨幣的用戶。

GST Coin

-

官網:http://www.gstcoin.io/

GST是一個綜合的數字應用平台,集成了加密支付貨幣、區塊鏈和人工智能技術,致力于爲每個用戶提供最有價值的智能數字資産服務,並在多元化的市場結構中創建新的GST數字公共鏈。GST項目致力于使用最先進的技術創造最完美的用戶體驗,並以去中心化的安全共享架構中始終處于市場最前沿。

GST誕生于MHC資産管理公司,這是一家從事區塊鏈技術研發與創新的高科技企業。他們的執行團隊包括首席執行官張群女士和中國其他領先的技術人員和企業家。

Columbu

-

官網:http://www.columbu.network/en/

Columbu(CAT)是一個基于社區的全球開源區塊鏈項目,自2017年開始運作。在CTO David Su的領導下,CAT的主要重點是基于軟件和硬件結合GCloud Everest計算平台,建立一個高性能DAPP開發平台和社區激勵及自治系統,這是全球第一個使用CUDA和區塊鏈技術的公共區塊鏈(分布式雲)。

該項目將允許智能經濟的全球分布式和自由經濟協作網絡。這將通過社區激勵機制和自主系統實時建立。該項目有一個雄心勃勃的路線圖,其中包括在其生態系統中發展其全球開發者社區和其他項目。

KBC

-

官網:https://karatgold-kbc.com/

KBC注冊于新加坡,是全球金融基礎設施和一系列以黃金爲核心産品的有力象征。這些産品包括一款名爲IMpulse K1的創新語音區塊鏈智能手機、一款名爲K-Merchant的加密支付商戶處理器,以及一個加密貨幣交換和交易平台。這些産品和實體結合在一起形成了黃金帝國,即公司的金融生態系統。

該公司吸引了大量用戶的興趣,他們看到了擁有黃金和加密貨幣的好處,以及通過KBC等令牌每天都能輕松使用的便捷性。隨著這兩個市場的擴張,可以密切關注KBC。

TEXCENT

-

官網:https://texcent.com/

TEXCENT是一家新加坡區塊鏈和金融科技創業公司,致力于全面整合彙款、支付和小額融資解決方案。TEXCENT希望利用區塊鏈技術爲亞洲乃至全世界提供無縫的、便捷的數字金融服務解決方案。TEXCENT目前專注于菲律賓、越南、泰國等國家,因爲這些市場將在未來5年內實現成倍的增長。

他們目前的産品包括PAYCENT——一款應用和混合錢包,以及TEXCENT,一款零費用的彙款解決方案。TEXCENT已經從新加坡金融管理局(MAS)獲得了彙款許可證,未來幾個月還將在英國、馬來西亞和香港獲得類似的許可證。該公司也是新加坡金融技術協會的成員之一。

【相關閱讀】

這些初創公司展示了區塊鏈在各個行業中的潛力

分散式網絡解決了許多行業的問題。因此,根據ABI Research的顯示數據,區塊鏈公司未來幾年的營收將達到100億美元也就不足爲奇了。

分布式賬本技術(DLT)指分散的、無信任的系統,根據加密貨幣專家Nick Szabo在《貨幣、區塊鏈和社交擴展性》一書中所說:

“社會可擴展性方面的創新包括制度和技術上的改進,將一項功能從思想轉移到紙上或思想轉移到機器上,降低認知成本,同時增加思想之間流動的信息的價值,減少脆弱性,以及/或尋找和發現新的互利參與者。”

根據國際數據公司(International Data Corp.)的數據,2018年至2023年,區塊鏈技術的5年複合年增長率(CAGR)將達到76%。

價值轉移

區塊鏈可以是一種安全的價值轉移媒介(就像比特幣網絡),其中節點就公共分類賬的狀態達成一致。Altcoins是較小的加密項目,吸引較小的利基市場。例如,Free Coin項目鼓勵沒有銀行賬戶的人使用密碼,並從法定基金轉爲數字基金。他們的技術支持低費用的點對點支付。

就拿一個成熟的項目全球數字資産(GDA)舉例來說,他們是一家專注于區塊鏈的商業銀行服務公司,通過風險投資,公共市場或貸款幫助區塊鏈企業籌集資金或獲得流動性。該公司還幫助企業構建公共設施和安全代幣産品(STO)。

數據保護

DLT在加密貨幣之外也有應用,從安全投票到供應鏈跟蹤。據世界經濟論壇稱,它大規模的應用將使全球GDP增長5%,貿易額增長15%。

區塊鏈非常適合跟蹤和保存數據,並且該功能可以與RFID標簽等物理硬件相結合,以改善物流,運輸和倉儲操作。

另一個區塊鏈應用是電子投票。由于擔心人爲幹擾,技術專家認爲區塊鏈驅動的電子投票更加安全和私密,一個例子是ZCoin,它于2018年底運用于泰國的大規模政治選舉。

還有一些網絡可以更容易地遵守監管框架。

Maxonrow的首席執行官Mark Homeier表示:“KYC(了解客戶)和AML(反洗錢)的含義不僅限于加密貨幣”,“區塊鏈有一種獨特的能力,可以讓KYC和AML識別度更高,同時在一定程度上保護用戶隱私,讓用戶控制自己的識別數據。”

Maxonrow是一個具有強制KYC驗證的高吞吐量事務區塊鏈。

DLT可以保護數據。Veridoc等項目旨在擾亂文件管理,其應用程序包括護照、土地所有權和教育證書的驗證。該公司最近與DocuSign合作,爲小企業帶來創新。

Contentos使用區塊鏈來轉換視頻的貨幣化和共享方式。該項目使用點對點模型來分配收入,並使用分散的方法來分配流量。該公司的技術認證版權,並安全地記錄用戶的信用評分,衡量平台上的貢獻。

成爲主流

區塊鏈適用于社交媒體和零售。德勤(Deloitte)2018年的一項調查顯示,41%的高管希望他們的組織在一年內實施區塊鏈。

Dyson Network提供了一種企業解決方案,可加速所有分散系統的交易,從而實現實時支付並提升所有區塊鏈性能。支付體驗將變得快速、簡單、友好,就像使用信用卡、PayPal、Square等支付方式一樣。

BitWallet在休斯頓德克薩斯州運營,減少了訪問加密的障礙。

BitWallet通過一款直觀的投資組合應用,簡化了加密貨幣的買賣和存儲。由于全球監管狀況分散,擁有多種加密貨幣的菲亞特網關很難獲得。

商家采用是主流采用的關鍵。

Vexanium是下一代區塊鏈,支持智能合約,分散式應用(dapps)和零售滲透。用戶在付款時不需要支付交易費用。爲了獲得廣泛的采用,開發人員構建的平台可以容納每秒2000個交易(TPS)。

Reddcoin是一個加密和區塊鏈項目,它驗證ID並允許在社交媒體渠道上提供信息。因此,支持者將reddcoin視爲一種社交商業工具。

DxChain迎合了支持隱私和數據安全的企業和消費者。分散的大數據網絡可保護敏感信息,並爲用戶提供控制其數據的能力。DxChain的數據存儲也可以保護隱私。

區塊鏈是一項創新技術,其功能包括無摩擦交易,防篡改記錄保存和數據隱私。企業可以利用其功能來改進其業務實踐。

10 Blockchain Companies To Watch In Asia

In 2018, Asia was one of the leading regions in terms of growth of blockchain jobs, cryptocurrency usage, innovation, and general openness. Despite some early woes with China banning ICOs, China still produces nearly 70% of crypto mining activity.

For users and entrepreneurs, the Asian ecosystem is in general a friendly one. For example, in Singapore Bitcoin is taxed as a good rather than a currency, setting a 7% flat tax for trades or purchases using Bitcoin. In Japan, messenger giant, LINE, was just granted a crypto exchange license from the Japanese financial regulator. In Korea, news just broke that the country’s largest entertainment company would be launching its own token.

Besides the name brand companies that are exploring crypto solutions, there are hundreds of innovative startups and founders looking to radically disrupt their respective industries with blockchain technology. This list contains ten innovative blockchain startups based in Asia worth watching, including exchanges, fintech startups, and more.

1. Level01

Level01 is the world’s first broker less derivatives exchange in collaboration with Thomson Reuters. Through using blockchain technology, the platform eliminates middlemen while providing a decentralized trading experience. Users can trade derivatives and options in forex, cryptocurrencies, commodities, stocks and indices, all from the Level01 platform and app.

Level01 does this by using Distributed Ledger Technology (DLT) for transparent and automated trade settlement on the blockchain, with their unique Artificial Intelligence (AI) analytics called Fairsense that provides fair value pricing dynamically to counterparties in a trade, based on current and retrospective market data from Thomson Reuters. The platform and app are currently undergoing stringent beta testing by 50 experienced traders.

2. Galaxy Pool

Galaxy Pool, also known as GPO, is a brand-new asset issuance style on blockchain that utilizes intelligent contracts for initial digital asset issuance. In general, GPO assets can be best described as mining machines used to explore various kinds of digital assets that can obtain value-added benefits of GPO through the repurchase and destruction of pond profits.

With this brand-new asset issuance style on blockchain, more humanistic investment opportunities with free withdrawal rights can be provided to investors.

3. Biki

Headquartered in Singapore, BiKi.com is a global cryptocurrency exchange ranked Top 20 on CoinMarketCap. BiKi.com provides a digital assets platform for trading more than 150 cryptocurrencies and 220 trading pairs. Since its official opening in August 2018, BiKi.com is considered one of the fastest-growing cryptocurrency exchanges in the world with an accumulated 1.5 million registered users, 130,000 daily active users, over 2000 community partners and 200,000 community members in under a year.

BiKi’s competitive advantages include helping projects with marketing, influencers, brand awareness, and community growth in the Chinese markets and abroad. With a global approach, BiKi also helps Chinese companies go global and international companies penetrate Chinese markets.

4. Whitebit

With a global team of over 100 people, Whitebit is a professional digital asset trading platform that services most major Asian markets via a European license. The exchange holds 95% of user funds in cold wallets and offers users an intuitive user interface with real-time orderbooks, charting and technical analysis tools, and automation features. Whitebit’s major competitive advantage is processing speeds of up to 10,000 trades every second and 1,000,000 TCP connections.

Whitebit has also announced the release of S.M.A.R.T. Box, a program that allows users to budget and allocate funds based on unique plans with varying durations and interest rates. Next is the launch of margin trading in Q4 2020, as well as mobile iOS and Android apps and an eventual US license.

5. Opu Labs

Opu Labs is creating the self-care business model of the future starting with the skincare space. There are over 1.2 billion online skincare consumers with a $3 billion digital services business. Opu Labs helps make the decision-making process easier by offering free advice powered by AI, rewarding users for their purchase data using blockchain technology, and using robust technologies to connect brands and consumers.

Under the leadership of CEO Marc Bookman, Opu Labs was named in the top 25 healthcare solutions by CIO Applications and won the start-up GrandSlam in Singapore. To date, $2m in rewards have been earned on the platform and the company will be releasing their long-awaited apps soon.

6. Coinsbit.io

Thanks to his vast expertise, experience, and sense of the market, Nikolay Udianskyi created a high-quality crypto exchange called Coinsbit.io. Now leading the Asian crypto market, Coinsbit was named the best 2018 crypto exchange at Asian Blockchain Life 2019.

Coinsbit is planning to further distinguish itself from the competition through a series of novel functions. Among its plans is a P2P microfinancing lending service that will enable users to borrow and lend money on the platform. Coinsbit will ensure privacy for all users and will not require borrowers to show their credit history. An additional planned feature is an invest box service, which will reward users who deposit cryptocurrency by paying them interest on various coins.

7. GST Coin

GST is a comprehensive digital application platform which integrates encrypted payment currency, blockchain and artificial intelligence technology. It is dedicated to providing the most valuable intelligent digital asset service for every user and creating a new GST digital public chain in a diversified market structure. GST project is committed to using the most advanced technology to create the most perfect user experience, and it has always been in the forefront of the market in the decentralized security sharing architecture.

GST was born out of MHC Asset Management Corporation, a high-tech enterprise engaged in R&D and innovation of blockchain technology. Their executive team includes CEO Ms. Zhang Qun and other leading technologists and entrepreneurs in China.

8. Columbu

Columbu (CAT) is a global community-based open-source blockchain project that has been active since 2017. Under CTO David Su, CAT’s main focus is building a high-performance DAPP development platform and community encouraging and autonomous system based on software and hardware combined GCloud Everest computing platform. This is the world’s first public blockchain (distributed cloud) using CUDA and blockchain technology.

The project will allow for a worldwide distributed and free economic collaborative network of intelligent economies. This will happen through a community incentive mechanism and autonomous system to build in real-time. The project has an ambitious roadmap that will include growing its global developer community and other projects within their ecosystem.

9. KBC

Registered in Singapore, KBC is the powering token of a global financial infrastructure and range of products focused around gold. These products include an innovative Voice-over-Blockchain smartphone called IMpulse K1, a crypto payment merchant processor called K-Merchant, and a cryptocurrency exchange and trading platform. Together these products and entities combine to form the Gold Imperium, the company’s financial ecosystem.

The company has attracted heavy interest from users who have seen the benefits of having both gold and cryptocurrency exposure, as well as the ease of use of being able to use each day to day through tokens such as KBC. As both markets expand, keep an eye on KBC.

10. TEXCENT

TEXCENT is a Singaporean blockchain and fintech startup focused on fully-integrated solutions for remittance, payments, and microfinancing. Using blockchain technology, the company wants to provide seamless and convenient digital financial services solutions to Asia and the world. TEXCENT is currently focusing on the Philippines, Vietnam, Thailand as these markets will grow exponentially in the next 5 years.

Their current products include PAYCENT, an app and hybrid wallet, as well as TEXCENT, a remittance solution with zero fees. TEXCENT has already acquired a remittance license from the Monetary Authority of Singapore (MAS) and is in the process of getting similar licenses for UK, Malaysia and Hong Kong in the coming months. The company is also a member of the Singapore Fintech Association.

【Related Reading】

These Startups Show Blockchain’s Potential In Various Industries

Decentralized networks solve problems across many industries. Thus, it’s no surprise that blockchain companies will reach $10 billion in revenue in the next couple of years, according to ABI Research.

Distributed ledger technologies (DLT) refer to decentralized, trustless systems, and according to cryptocurrency guru Nick Szabo in “Money, Blockchains and Social Scalability”:

“Innovations in social scalability involve institutional and technological improvements that move a function from mind to paper or mind to machine, lowering cognitive costs while increasing the value of information flowing between minds, reducing vulnerability, and/or searching for and discovering new and mutually beneficial participants.”

The technology will see a 5-year compound annual growth rate (CAGR) of 76% between 2018-2023, according to International Data Corp.

Value Transfer

Blockchain can be a secure medium for value transfer (like the Bitcoin network), where nodes agree on the status of a public ledger. Altcoins, which are smaller crypto projects, appeal to smaller niches. For example, the Free Coin project encourages unbanked people to use crypto, and to switch from fiat to digital funds. Their tech enables peer-to-peer payments that feature low fees.

A sophisticated project is Global Digital Assets (GDA), a blockchain-focused merchant banking services firm. It helps blockchain ventures to raise funds or gain liquidity through venture capital, public markets, or loans. The firm also helps companies to structure utility and security token offerings (STOs).

Securing Data

DLT has applications outside of cryptocurrencies, from secure voting to supply chain tracking. According to World Economic Forum, wide-scale adoption will lead to 5% increase in global GDP and 15% increase in trade volume.

Blockchains are excellent at tracking and preserving data, and the capability can be combined with physical hardware like RFID tags to improve logistics, shipping, and warehousing operations.

Another application is e-voting. Due to concerns with interference, technologists view blockchain-powered e-voting as more secure and private. An example is ZCoin, which launched a large-scale political election in Thailand in late 2018.

There are also networks that make it easier to comply with regulatory frameworks.

“The implications of KYC (know your customer) and AML (anti-money laundering) extend beyond cryptocurrencies,” says Mark Homeier, CEO of Maxonrow. “Blockchains have a unique capability to make KYC and AML identification better while preserving user privacy to a specific extent, and concurrently handing users control over their own identification data.”

Maxonrow is a high-throughput transaction blockchain with mandatory KYC verification.

DLT can protect data. Projects like Veridoc aim to disrupt document management, and applications include the verification of passports, land titles, and education certificates. The company recently partnered with DocuSign to bring the innovation to small businesses.

Contentos uses blockchain to transform how videos are monetized and shared. The project uses a peer-to-peer model for distributing revenue, and uses a decentralized approach for distributing traffic. The firm’s tech authenticates copyrights, as well as securely records users’ credit score, which measures contributions on the platform.

Going Mainstream

Blockchain is applicable in social media and retail. Forty-one percent (41%) of executives expect their organization to implement blockchain within a year, according to a 2018 survey by Deloitte.

Dyson Network provides an enterprise solution to accelerate transactions for all decentralized systems which would enable real-time payment and promote all blockchain performance. Payment experience will become fast, easy and friendly just like using a credit card, PayPal, Square and other payment methods.

BitWallet, which operates out of Houston Texas, reduces the barrier to accessing crypto.

BitWallet simplifies the buying, selling, and storing of cryptocurrencies with an intuitive portfolio app. Fiat gateways with multiple cryptocurrencies are hard to come by with fragmented regulatory statuses around the world.

Merchant adoption is crucial for mainstream adoption.

Vexanium is a next-gen blockchain that supports smart contracts, decentralized applications (dapps), and retail penetration. Users don’t incur a transaction fee when making payments. To gain mass adoption, developers built the platform to accommodate 2,000 transactions per second (TPS).

Reddcoin, a crypto and blockchain project, verifies IDs and enables tipping on social media channels. Supporters, therefore, look at Reddcoin as a social commerce tool.

DxChain caters to enterprises and consumers who favor privacy and data security. The decentralized big-data network protects sensitive info, and gives users the power to control their data. DxChain’s data storage also protects privacy.

Blockchain is an innovation whose functions include frictionless transactions, tamper-proof recordkeeping, and data privacy. Organizations can tap into its capabilities to improve their business practices.

– END –

關注我們

區塊鏈,人工智能,

行業相關資訊 ,幹貨,

報告等,可搜索

數據觀微信公衆號

進入查看。

數據觀

公衆號:cbdioreview

官網:www.cbdio.com

微博:數據觀官微