While research and experimentation with blockchain technology across sectors has been underway for several years, few organizations have deployed it. Although central banks are among the most cautious and prudent institutions in the world, a new white paper published by the World Economic Forum indicates that these institutions, perhaps surprisingly, are among the first to implement blockchain technology.

雖然跨部門的區塊鏈技術的研究和實驗已經進行了幾年,但是很少有組織部署它。盡管各國央行是世界上最謹慎、最謹慎的機構之一,但世界經濟論壇(world Economic Forum)發表的一份最新白皮書顯示,這些機構或許出人意料地率先實施了區塊鏈技術。

Central bank activities with blockchain and distributed ledger technology (DLT) are not always well known or communicated. As a result, there is a lot of speculation and misunderstanding. Yet dozens of central banks around the world – from Sweden to South Africa to Singapore – are actively investigating whether blockchain can help solve long-standing issues in banking, such as payment-system efficiency, payment security and resilience, as well as financial inclusion.

央行使用區塊鏈和分布式分類帳技術(DLT)進行的活動並不總是衆所周知或相互溝通的。因此,有很多猜測和誤解。然而,從瑞典到南非,再到新加坡,全球數十家央行都在積極調查區塊鏈能否幫助解決銀行業長期存在的問題,比如支付系統效率、支付安全和彈性,以及金融包容性。

These organizations, tasked with overseeing a nation’s monetary policy and financial and economic stability, are very cautious to implement any technology or solution that can have adverse consequences. Yet many central banks are actively researching a variety of use cases to explore the technology’s potential in controlled, secure settings.

這些組織的任務是監督一個國家的貨幣政策、金融和經濟穩定,它們非常謹慎地執行任何可能産生不利後果的技術或解決方案。然而,許多央行正在積極研究各種用例,以探索該技術在受控、安全設置中的潛力。

Top 10 central bank use cases

央行的十大用例

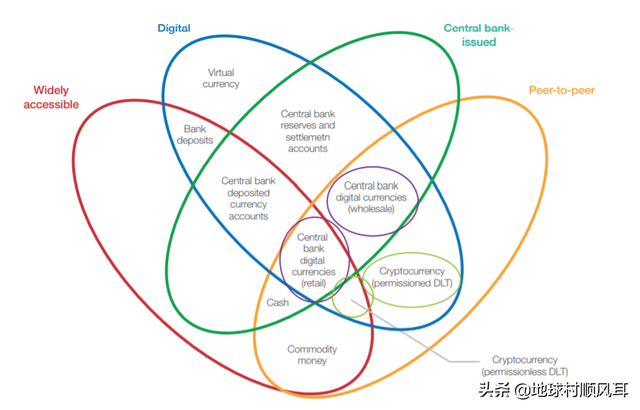

1. Retail central bank digital currency (CBDC) – A central bank-issued digital currency that is operated and settled in a peer-to-peer and decentralized manner (with no intermediary) and is widely available for consumer use. This form of CBDC serves as a complement or substitute for physical cash and an alternative to traditional bank deposits. Central banks from several countries are experimenting with this, including those from the eastern Caribbean, Sweden, Uruguay, the Bahamas and Cambodia.

1. 零售中央銀行數字貨幣(CBDC) -中央銀行發行的數字貨幣,以點對點和分散的方式(沒有中介)運行和結算,廣泛供消費者使用。這種形式的CBDC作爲實物現金的補充或替代品,是傳統銀行存款的替代品。一些國家的央行正在嘗試這種做法,包括東加勒比、瑞典、烏拉圭、巴哈馬和柬埔寨的央行。

2. Wholesale CBDC – A central bank-issued digital currency that is operated and settled in a peer-to-peer and decentralized manner (with no intermediary) but is only available only for commercial banks and clearing houses for use in the wholesale interbank market. Central banks researching this include those from South Africa, Canada, Japan, Thailand, Saudi Arabia, Singapore and Cambodia.

2. 批發CBDC——中央銀行發行的一種數字貨幣,以點對點和分散的方式運行和結算(沒有中間機構),但僅供商業銀行和清算機構在批發銀行間市場使用。研究這一問題的央行包括來自南非、加拿大、日本、泰國、沙特阿拉伯、新加坡和柬埔寨的央行。

3. Interbank securities settlement – A focused application of blockchain-based digital currency, including CBDC, enabling the rapid interbank clearing and settlement of securities for cash. The goal is to develop “delivery versus payment” interbank systems where two parties trading an asset, such as a security for cash, can conduct the payment for and delivery of the asset simultaneously. Central banks exploring this option include the Bank of Japan, Monetary Authority of Singapore, Bank of England and Bank of Canada.

3.銀行間證券結算-專注于基于區塊鏈的數字貨幣的應用,包括CBDC,使銀行間證券的現金快速清算和結算。其目標是開發“交付與支付”銀行間系統,在該系統中,交易一項資産(如現金擔保)的雙方可以同時進行該資産的支付和交付。正在探索這一選項的央行包括日本央行(Bank of Japan)、新加坡金融管理局(Monetary Authority of Singapore)、英國央行(Bank of England)和加拿大央行(Bank of Canada)。

4. Payment system resiliency and contingency – The use of DLT in a primary or backup domestic interbank payment and settlement system to provide safety and continuity from threats, including technical or network failure, natural disaster, cybercrime and other threats. Often, this use case is coupled with others as part of the set of benefits that a DLT implementation could potentially offer. The central banks researching this use case include the Central Bank of Brazil and the Eastern Caribbean Central Bank.

4. 支付系統的彈性和偶然性-在國內銀行間支付和結算系統的主要或備份中使用DLT,以提供安全性和連續性,免受威脅,包括技術或網絡故障、自然災害、網絡犯罪和其他威脅。通常,這個用例與其他用例結合在一起,作爲DLT實現可能提供的一系列好處的一部分。研究這個用例的中央銀行包括巴西中央銀行和東加勒比中央銀行。

5. Bond issuance and lifecycle management – The use of DLT in the bond auction, issuance or other lifecycle processes to reduce costs and increase efficiency. This concept could be applied to bonds issued and managed by sovereign states, international organizations or government agencies. Central banks or government regulators could be “observer nodes” to monitor activity where relevant. The World Bank launched the first blockchain-based bond, called the “bond-i”, in August 2018.

5. 債券發行和生命周期管理-在債券拍賣、發行或其他生命周期過程中使用DLT,以降低成本和提高效率。這一概念可適用于主權國家、國際組織或政府機構發行和管理的債券。央行或政府監管機構可以成爲“觀察節點”,在相關領域監控活動。2018年8月,世界銀行發行了第一種區塊鏈債券,名爲“邦德-i”。

6. Know your customer (KYC) and anti-money-laundering (AML) – Digital KYC/AML processes that leverage DLT to track and share relevant customer payment and identity information to streamline processes. This solution could connect to a digital national identity platform or plug into pre-existing e-KYC or AML systems. It also could potentially interact with CBDC as part of payments and financial activity tracking. Central banks exploring it include the Hong Kong Monetary Authority.

6. 了解您的客戶(KYC)和反洗錢(AML)-利用DLT跟蹤和共享相關客戶支付和身份信息以簡化流程的數字KYC/AML流程。該解決方案可以連接到數字國家身份平台,或插入現有的e-KYC或AML系統。它還可能與CBDC互動,作爲支付和金融活動跟蹤的一部分。正在探討這一問題的央行包括香港金融管理局(Hong Kong Monetary Authority)。

7. Information exchange and data-sharing – The use of distributed or decentralized databases to create alternative systems for information and data sharing between or within related government or private sector institutions. Among others, the Central Bank of Brazil is researching this use case.

7. 信息交換和數據共享-使用分布式或分散的數據庫,爲相關政府或私營部門機構之間或內部的信息和數據共享創建替代系統。巴西央行正在研究這個用例。

8. Trade finance – The employment of a decentralized database and functionality to enable faster, more efficient and more inclusive trade financing. This improves on today’s trade finance processes which are often paper-based, and labour- and time-intensive. Customer information and transaction histories are shared between participants in the decentralized database, while maintaining privacy and confidentiality where needed. Central banks researching this include the Hong Kong Monetary Authority.

8. 貿易融資-使用分散的數據庫和功能,使貿易融資更快、更有效和更具包容性。這改善了目前的貿易融資流程,這些流程通常以紙張爲基礎,勞動和時間密集。在分散的數據庫中,客戶信息和事務曆史在參與者之間共享,同時在需要時維護隱私和機密性。研究這一問題的央行包括香港金融管理局(Hong Kong Monetary Authority)。

9. Cash money supply chain – The use of DLT for issuing, tracking and managing the delivery and movement of cash from production facilities to the central bank and commercial bank branches. This could include the ordering, depositing or movement of funds, and could simplify regulatory reporting. Central banks exploring include the Eastern Caribbean Central Bank.

9. 現金貨幣供應鏈-使用DLT發行、跟蹤和管理從生産設施到中央銀行和商業銀行分支機構的現金交付和流動。這可能包括資金的訂購、存放或轉移,並可能簡化監管報告。正在探索的央行包括東加勒比央行(Eastern Caribbean Central Bank)。

10. Customer SEPA Creditor Identifier (SCI) provisioning – A blockchain-based decentralized sharing repository for Single Euro Payment Area (SEPA) credit identifiers, managed by the central bank and commercial banks in the SEPA debiting scheme, could offer a faster, more streamlined, decentralized system for identity provisioning and sharing. It could replace pre-existing manual and centralized processes that are time- and resource-intensive. This has already been implemented in the Bank of France’s Madre project.

10. 客戶SEPA債權人標識符(SCI)供應-一個基于區塊鏈的分散共享存儲庫,用于單一歐元支付區(SEPA)信用標識符,由中央銀行和商業銀行在SEPA借方計劃中管理,可以提供一個更快、更精簡、分散的身份供應和共享系統。它可以替代現有的手工和集中式流程,這些流程需要大量的時間和資源。這已經在法國銀行的Madre項目中實施。

For each of these use cases (listed in order of popularity), there is at least one central bank actively researching this area. This research and experience vary across countries, and many central bank researchers have yet to conclude whether DLT can provide value to their processes given salient risks and limitations.

對于這些用例中的每一個(按流行程度列出),至少有一個中央銀行在積極地研究這個領域。各國的研究和經驗不盡相同,許多央行研究人員尚未得出結論,考慮到明顯的風險和局限性,DLT是否能夠爲他們的過程提供價值。

In rare cases, such as with the Bank of France, a central bank has successfully deployed a DLT-based application. In other cases, central banks have concluded that blockchain technology does not provide valuable opportunities for their economies when considering the risks and downsides. At the very least, many are monitoring developments among peer institutions and within the private cryptocurrency markets.

在極少數情況下,比如法國央行,央行已經成功地部署了一個基于dll的應用程序。在其他情況下,各國央行已經得出結論,在考慮風險和不利因素時,區塊鏈技術並沒有爲它們的經濟提供寶貴的機會。至少,許多機構正在監控同行機構之間以及私人加密貨幣市場內部的事態發展。

Over the next four years, we should expect to see many central banks decide whether they will use blockchain and DLT to improve their processes and economic welfare. Given the systemic importance of central bank processes, and the relative immaturity of blockchain technology, the banks must carefully consider all known and unknown risks to implementation.

在未來四年,我們應該會看到,許多央行將決定是否使用區塊鏈和DLT來改善它們的流程和經濟福利。鑒于央行流程的系統性重要性,以及區塊鏈技術相對不成熟,銀行必須認真考慮實施過程中所有已知和未知的風險。

來源:FINTECH RANKING